- Personal

- Business

- Company Help

Start saving, lending, and investing, right from campus.

Bargg is the student-first fintech app that helps you grow your money, build trust, and take control of your future.

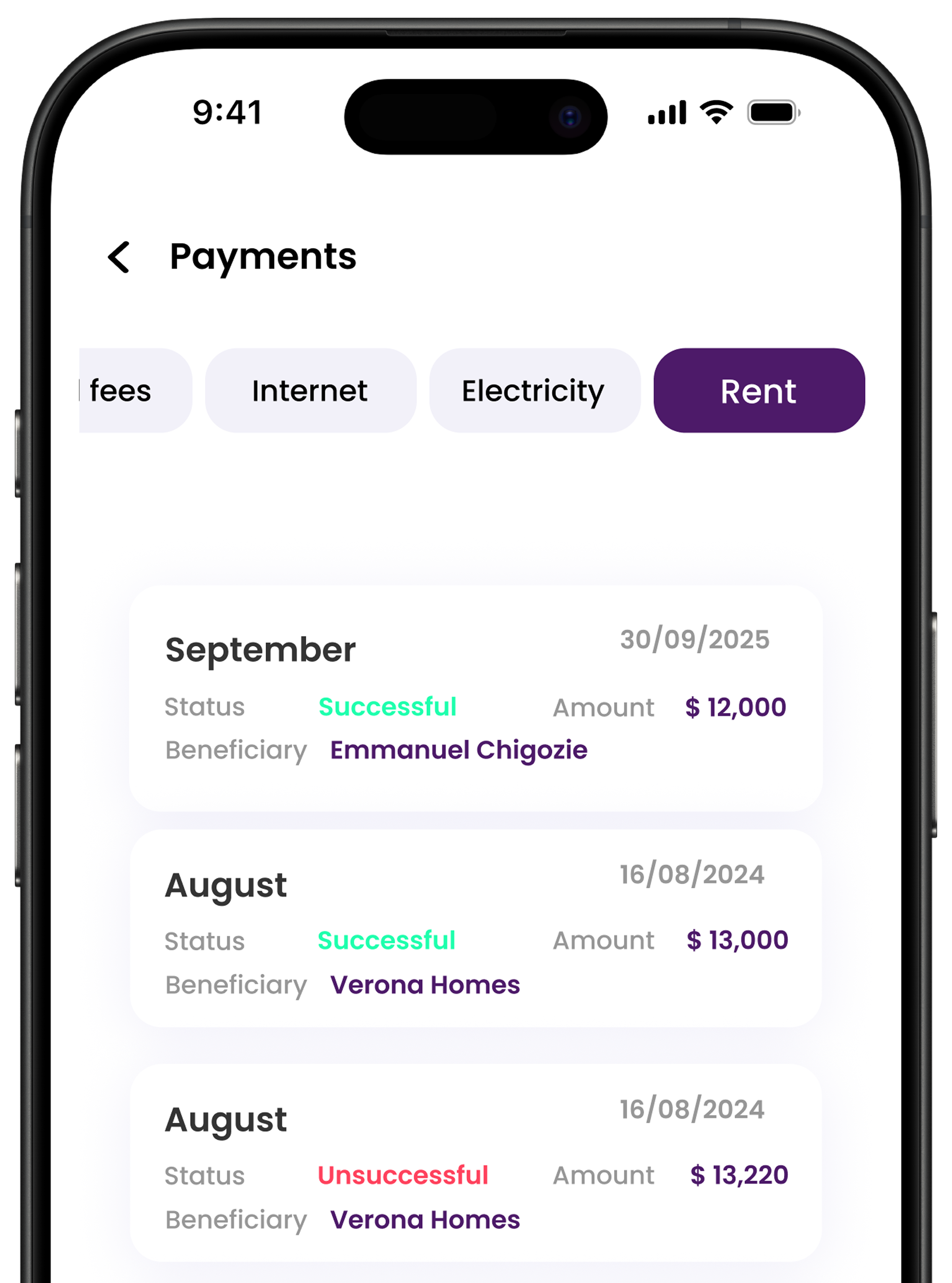

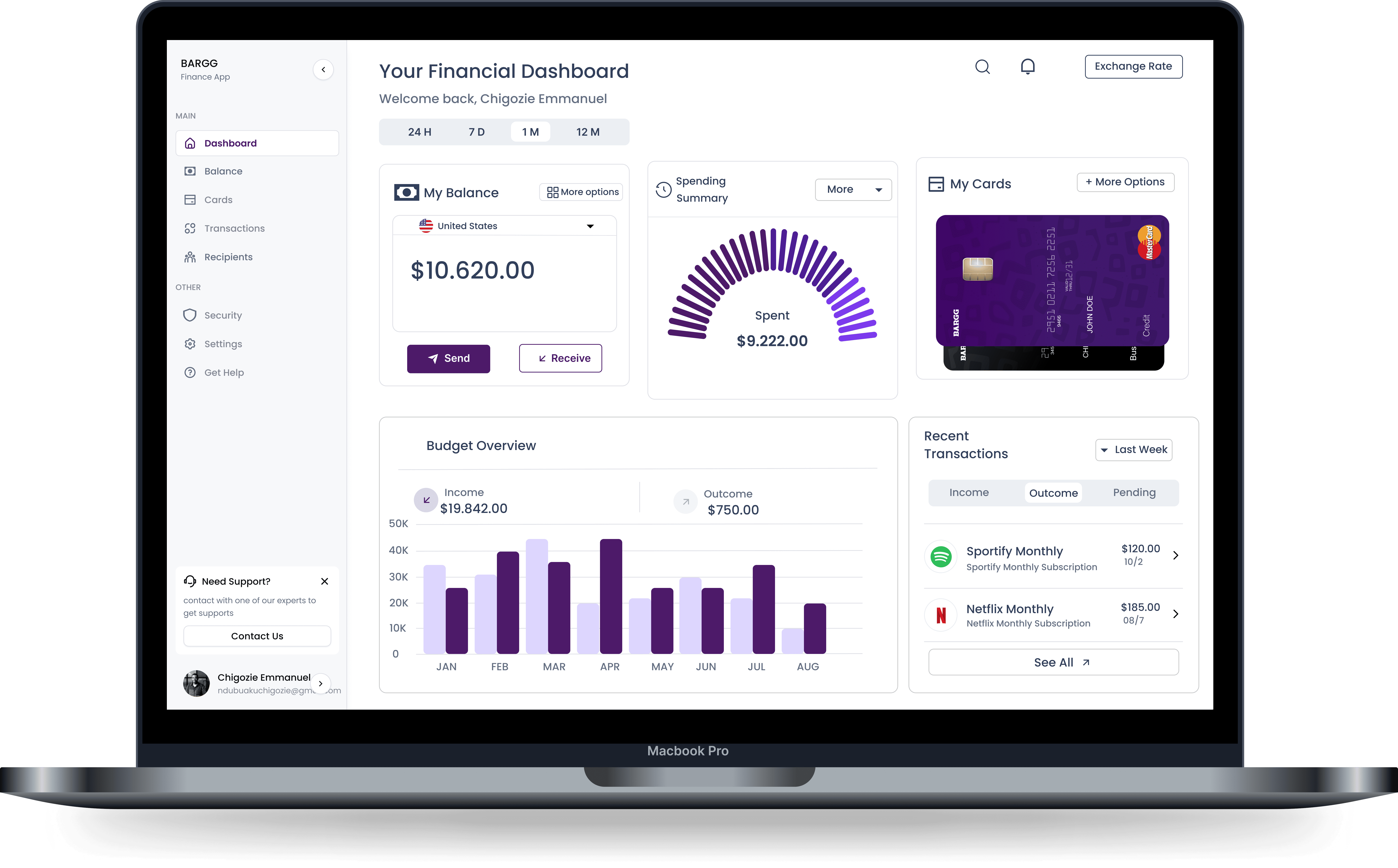

Make payments the easy way

Bargg simplifies your everyday transactions. Pay bills, top up airtime, and send money instantly, all from one sleek, secure dashboard.

Learn More →

Invest in Your Future

Start investing with as little as $1 and access a range of low-cost ETFs and stocks to help you reach your financial goals.

Simple Steps toFinancial Freedom

Whether you're borrowing, saving, or investing, BARGG makes it easy

Request a Loan

Submit your loan request with the amount you need (e.g., $500 for rent) and repayment timeline.

Get Verified

We verify your student status using your .edu email or student ID. Quick and secure.

Lenders Fund

Peer lenders review your request and fund it at competitive rates (typically 5% interest).

Receive & Repay

Funds are released to your account. Repay monthly through the app with automated reminders.

Example: Emergency Laptop Repair

Sarah needs $300 to fix her laptop before exams. Banks deny her loan. On BAGG, she receives funding from 3 peers at 5% interest (vs 25% payday loan), repayable once her part-time job generates income.

Small amounts matter on BARGG

Our Journey toTransform Student Finance

A clear path from MVP to market leader in student financial services

MVP Launch

Growth & Enhancement

Scale & Expansion

Join Us on This Journey

Be part of the financial revolution for students. Early adopters get exclusive benefits and lifetime discounts.